Frugal Living Tips for Families in High-Cost Cities

Budget Basics: Know Where Your Money Goes

If you’re living in a pricey city, your budget needs to be your best friend. And just like any friendship, it starts with honesty.

Write down every dollar you spend for a month. Yes, even that $3 iced coffee you “forgot” about.

Snacks, parking meters, gum at the checkout—track it all. Those tiny purchases love to gang up on you.

Use free tools like Mint or YNAB. Or go old-school with a spreadsheet and your favorite pen (purple glitter gel pen, anyone?).

Set limits for things like groceries, eating out, and fun stuff. Then turn it into a challenge to stay under each one.

Get the whole crew involved! Chat about money at dinner like it’s just another part of life.

Let your kids help pick a savings goal, like a backyard pool float that’s shaped like a flamingo. The sillier, the better.

Use sticker charts or colorful posters to track savings. Watching the “goal thermometer” rise is weirdly exciting.

Peek at your budget every week. If something’s going off-track, catch it early—like spotting a milk mustache before school photos.

Try using cash for fun purchases. Once it’s gone, that’s it—no magic money trees here.

Being frugal isn’t about saying “no” all the time. It’s about saying “yes” to what matters most (like pizza night AND future vacations).

Smart Grocery Shopping

Grocery shopping in big cities can feel like a game of “Will This Apple Cost $2?” But there are ways to play smarter.

Start with meal planning. Knowing what’s for dinner beats standing in front of the fridge wondering if pickles count as a meal.

Make a grocery list and stick to it like glue. Or duct tape. Or sticky spaghetti.

Never shop when you’re hungry. That’s how you end up with 3 bags of chips and no actual food.

Buy in bulk if it’s something you use a lot—like rice or toilet paper. But don’t go wild buying 70 yogurts unless you’re feeding a small army.

Wasting food is like tossing money in the trash. Store things right so they don’t turn fuzzy and weird.

Go generic! Store brands are often the same as name brands—except cheaper and not trying to impress anyone.

Use apps like Ibotta or Fetch to get cash back. It’s like a tiny reward for adulting.

Always check unit prices (those tiny shelf tags). Sometimes the bigger jar isn’t the better deal!

Try to do just one grocery trip a week. Fewer trips = fewer impulse candy bars (I know, I’m sad about it too).

Visit local farmer’s markets or ethnic stores. You’ll find fresh stuff and fun ingredients without the fancy prices.

Sign up for store rewards programs. That random email coupon might just save dinner.

Affordable Housing Hacks

Living in a high-cost city? Housing can eat your wallet, but there are some sneaky ways to save.

Smaller spaces = smaller rent. Plus, less space means fewer rooms to clean and more excuses to ignore laundry.

Use smart storage like bins under the bed and shelves that hang over doors. Every inch is prime real estate.

Some families live in micro-apartments or even tiny homes. It’s like playing real-life Tetris (but with kids and laundry).

Share your space with another family or friends. Just make sure there are clear house rules—like “no singing show tunes at 6 a.m.”

Look in up-and-coming neighborhoods. They may not have trendy coffee shops yet, but they cost a lot less.

Ask about deals for longer leases. Some landlords love the idea of not finding new tenants every year.

Always try to negotiate rent. Worst case, they say no—but sometimes they say yes!

Use thick curtains to keep your place warm in winter and cool in summer. Bonus: you can sleep in like a vampire.

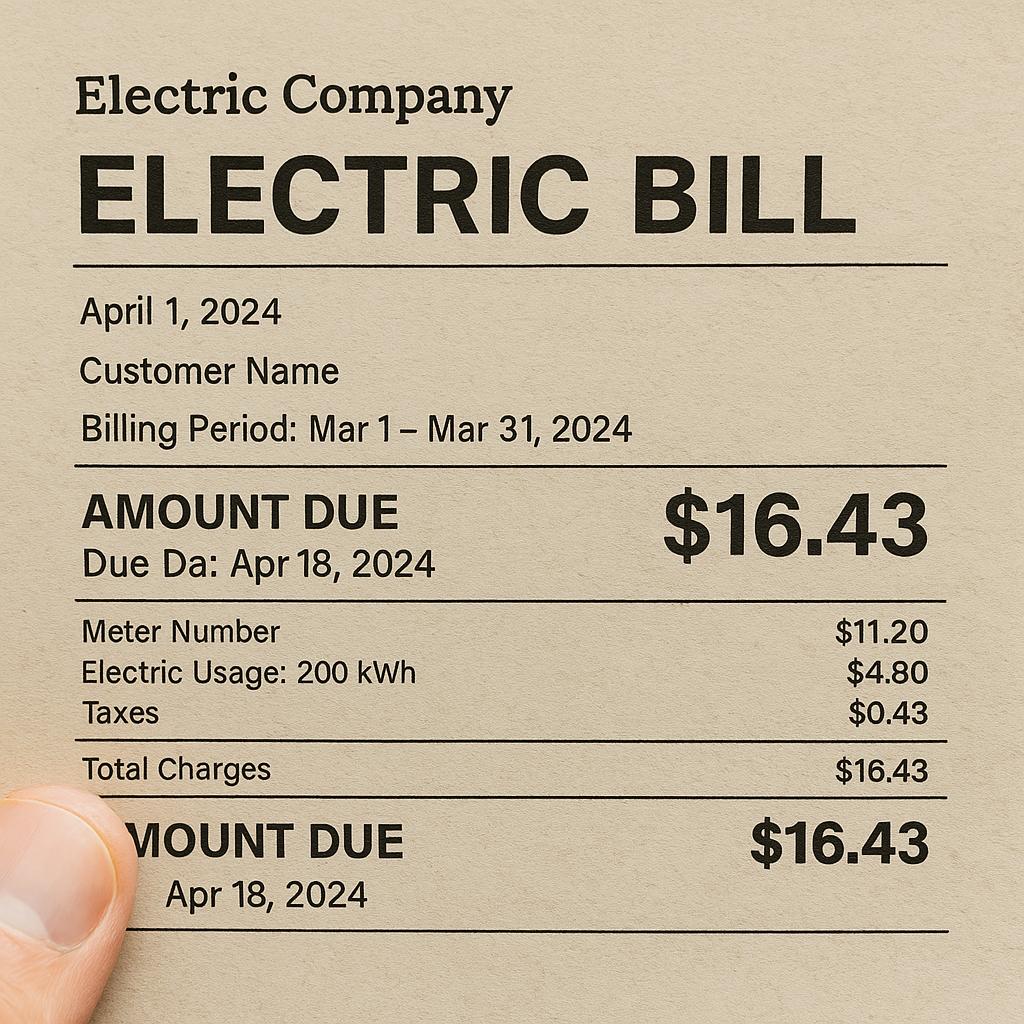

Turn off lights, unplug electronics, and use LED bulbs. They’re like tiny superheroes saving your electric bill.

Bundle your internet, phone, and TV if you can. Then call once a year and ask, “Can I get a better deal?” (You usually can.)

Transportation on a Budget

Getting around doesn’t have to be a budget-buster—especially in the city.

Public transportation can be your wallet’s BFF. Look for family passes or monthly deals.

Biking or walking saves money and keeps your legs strong enough to carry all the groceries you just bought in bulk.

Carpool with friends, coworkers, or other parents. There are even apps that can help match you with someone fun (and hopefully not too chatty).

Keep your car in good shape. A little tire check today saves you from the “Why-is-my-car-smoking?” panic later.

Do regular oil changes and brake checks. It’s like brushing your teeth—small effort now, big savings later.

Use GasBuddy or Upside to find the cheapest gas near you. Why pay more for the same juice?

If you drive to work, look for parking passes or commuter discounts. Some jobs even help pay for it.

Low-mileage drivers should check out pay-per-mile insurance. It’s like a gym membership but for your car—and you actually use it.

Drive less when you can. The fewer trips, the fewer gas station snacks you’ll be tempted by.

Being frugal means finding the best way to go from A to B—with a detour at the cheapest taco truck.

Family Fun Without the High Price Tag

Fun doesn’t have to be fancy—or expensive. Some of the best laughs are totally free.

Check out your local parks or beaches. Nature has zero admission fees and unlimited adventure.

Look for free museum days or city events online. Libraries and city websites are treasure maps to hidden fun.

Libraries are magical places that offer way more than books. Movies, games, tools, even seeds for your garden!

Have a family game night using board games or silly paper games like Pictionary with stick figures.

Invite friends over for a potluck dinner. Everyone brings a dish, and nobody has to wash 12 pots after.

Pack a picnic and eat outside. Something about eating sandwiches on a blanket makes them taste fancier.

Go to local fairs or festivals. There’s usually live music, fun booths, and fried things on sticks.

Camp in your backyard with a tent and marshmallows. Bonus points for spooky stories under flashlights.

Make crafts with stuff you already have—like paper towel tubes and glitter. (Just maybe not together.)

Fun isn’t about spending money—it’s about time, love, and maybe a few peanut butter sandwiches.

School and Childcare Savings

Schools and childcare can cost a lot—but you’ve got options.

Public schools are free and often full of cool clubs or programs. Ask around—you might be surprised.

Look for scholarships or fee waivers for camps and lessons. Many places help if you just ask (nicely, with your “please” voice).

Trade childcare with friends. You watch their kids on Tuesday, they watch yours on Friday—it’s like babysitting tag.

That’s called a co-op, and it can save a ton. Plus, your kid gets a buddy to play with.

Swap services with other parents! Maybe you tutor math while they give piano lessons.

Shop back-to-school sales and stock up. Glue sticks and crayons are way cheaper in August.

Check thrift stores for uniforms or backpacks. Sometimes they even still have the price tag!

Pack lunches most days. It’s cheaper and lets you sneak in your kid’s favorite jelly.

Use reusable containers instead of plastic bags. Saves money and the planet, too!

Always, always ask about free or discounted supplies. Schools might not advertise it, but help is often there if you ask.

Cut Utility and Subscription Costs

Monthly bills can be sneaky, but you can outsmart them.

Turn off lights when you leave the room. Your plants don’t need to see at night.

Unplug chargers and electronics. Yep, they use energy even when they’re “off.”

LED bulbs are like the long-lasting lightbulbs of your dreams. Bright, cheap, and they last forever (almost).

Program your thermostat to use less heat or AC when you’re out. Your couch doesn’t care if it’s chilly.

Keep showers short. Put on a two-minute song and make it a race.

Wash clothes in cold water. They still get clean, and your power bill stays friendly.

Hang clothes to dry when you can. It’s gentle on them and your wallet.

Check your subscriptions—music, streaming, fitness, oh my! Cancel ones you don’t really use.

Use free versions of your favorite apps. Ads aren’t that bad when they save you $10 a month.

Review bills every few months. Companies love to sneak in new charges—don’t let them!

Earn Extra Income Together

Sometimes saving isn’t enough—you gotta bring in extra dough (or at least cookie money).

Try side gigs like freelancing, tutoring, or selling crafts. Even a few hours a week helps.

Websites like Etsy, Upwork, and Fiverr make it easier than ever to get started.

Sell stuff you don’t need anymore. That old stroller? Someone out there wants it.

Hold a yard sale or post items online. And boom—decluttered AND paid.

Older kids can help too. Mowing lawns or dog walking are great ways to earn.

It teaches kids about money, effort, and not spending it all on candy.

Use cashback apps when you shop. It’s like finding coins in your couch—but on purpose.

Some credit cards offer points or cashback. Just promise me you’ll pay them off monthly, okay?

Redeem cans and bottles for cash if your state pays for them. Eco-saving and money-making? Yes, please.

Seasonal jobs during holidays are great for extra income. Stores love extra help in November and December.

Use that money for something big—like a vacation, a rainy day fund, or a giant inflatable unicorn for the pool. You’ve earned it!